Jumbo mortgage benefits & guidelines

Whether you’ve outgrown your starter home or are ready to upgrade, a jumbo loan could help you afford a more expensive home. A jumbo loan is simply a larger mortgage for a home that exceeds loan limits and is classified as non-conforming by a government agency. Certain areas of the country may have higher limits due to regional real estate prices.

Why choose a jumbo mortgage?

Homebuyers opt for jumbo mortgages when they need to borrow more than loan limits set by the Federal Housing Finance Agency (FHFA). The good news for borrowers is that jumbo loans often are available with mortgage rates similar to conforming loans.

Jumbo mortgage guidelines

To qualify for a Jumbo mortgage, you will need:

While a 20% down payment is standard, some lenders—like Rate—offer options starting at 10% for qualified borrowers. Jumbo loans usually don’t require mortgage insurance, providing a cost-saving benefit for those meeting the lender’s requirements.

Jumbo 30-year fixed

0.000%

What are the current jumbo loan rates?

The average annual percentage rate (APR) for a jumbo loan is often comparable to conforming mortgages—and in some cases, it can even be lower. Your final rate will depend on your credit score and history of managing debt.

Use the button to see current rates for a jumbo home loan. See mortgage rate disclaimers for assumptions and details.

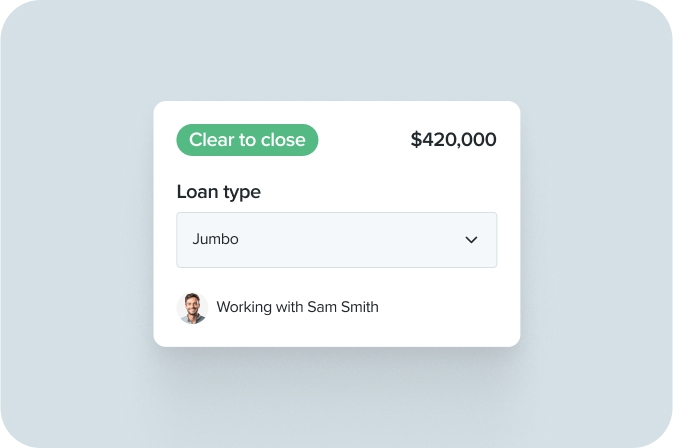

How to apply for a jumbo mortgage

Applying for a jumbo loan is simple with our Digital Mortgage. Follow these steps.

1. Review your finances

Check your credit score, income, DTI ratio and cash on hand for a down payment.

1. Review your finances

Check your credit score, income, DTI ratio and cash on hand for a down payment.

2. Gather key documents

In most cases, you’ll need to provide income verification, tax returns, asset statements and personal identification.

3. Apply online

Once you submit your application, your Loan Officer will help you from there.

“Awesome experience. Loan was closed within 30 days. There was absolutely no hassle. Great team work. Will use them again and highly recommend them.”

Applicant subject to credit and underwriting approval. Not all applicants will be approved for financing. Receipt of application does not represent an approval for financing or interest rate guarantee. Restrictions may apply.

Savings, if any, vary based on the consumer’s credit profile, interest rate availability, and other factors. Contact Rate for current rates. Restrictions apply.

*Approval may be granted in five minutes but may be subject to verification of income and employment. Five business day funding timeline assumes closing the loan with our remote online notary. Funding timelines may be longer for loans secured by properties located in counties that do not permit recording of e-signatures or that otherwise require an in-person closing. In addition, funding timelines may be longer if we cannot readily verify that your property is in at least average condition with no adverse external factors with a property condition report and may need to order a desktop appraisal to confirm the value of your property.

Rate is a private corporation organized under the laws of the State of Delaware. It has no affiliation with the US Department of Housing and Urban Development, the US Department of Veterans Affairs, the Nevada Department of Veterans Services, the US Department of Agriculture, or any other government agency. No compensation can be received for advising or assisting another person with a matter relating to veterans’ benefits except as authorized under Title 38 of the United States Code.

Sources: https://www.hud.gov/program_offices/housing/sfh/ins/streamline