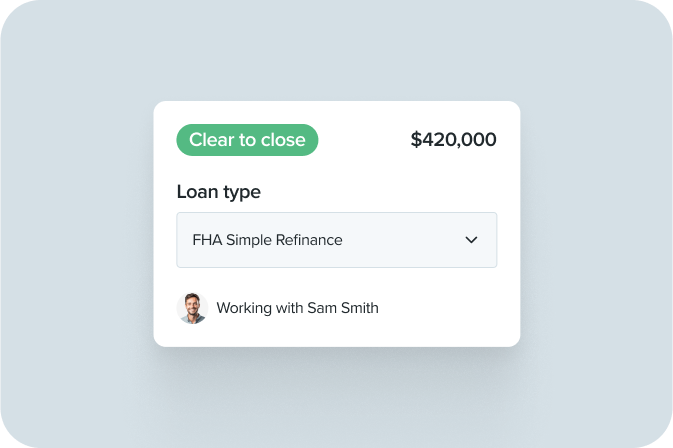

FHA Simple Refinance benefits & guidelines

If you have an FHA mortgage, you could take advantage of an FHA Simple Refinance that could lock in a lower rate and help you keep more of your money each month. FHA refinance guidelines call for less paperwork and minimal hassle, so you won’t even need income verification or a credit check.

.png)

Why choose an FHA Simple Refinance?

For homeowners with a current FHA mortgage, an FHA Simple Refinance could allow you to shorten your loan term, change from a variable rate to a fixed rate or secure a lower mortgage interest rate to reduce your monthly payments.

FHA Simple Refinance guidelines

To qualify for an FHA Simple Refinance, you will need:

- Current FHA loan

- No missed or late payments in the past 12 months

- Home appraisal

If you purchased your home with someone who no longer needs to be on the loan, an FHA Simple Refinance provides a straightforward way to update your loan structure. You also will need an appraisal to determine your home’s current value, and you must be current on payments.

How to apply for an FHA Simple Refinance

Applying for an FHA Simple Refinance is easy with Rate’s Digital Mortgage. Follow these steps.

1. Contact an FHA-approved lender

Reach out to one of Rate’s FHA-approved loan officers.

1. Contact an FHA-approved lender

Reach out to one of Rate’s FHA-approved loan officers.

2. Gather key documents

Your Loan Officer will let you know which documents you’ll need to provide. You may also have to prove that you occupy the home you’re refinancing.

3. Apply online

Once you submit your application, your Loan Officer will help you from there.

4. Home appraisal

Your home will need to be appraised to assess current market value. Your Loan Officer can help you schedule a time for an appraisal.

.png)

“They were able to smoothly convey trust and dedicated support to me and my wife during a home purchase. I would highly recommend this team to prospective home buyers.”

Applicant subject to credit and underwriting approval. Not all applicants will be approved for financing. Receipt of application does not represent an approval for financing or interest rate guarantee. Restrictions may apply.

*Savings, if any, vary based on consumer’s credit profile, interest rate availability, and other factors. Contact Rate, Inc. for current rates. Restrictions apply.

Sources:

https://www.hud.gov/sites/documents/FY16_SFHB_MOD6_PROGRAM.PDF

![[Cloned 08/13/25 09:00]: testimonial - zillow](https://images.contentstack.io/v3/assets/blt4bf507db5c9bc5ae/blt117adfb03be9f144/687ab60580a8861e82d97030/zillow_logo-png.png)