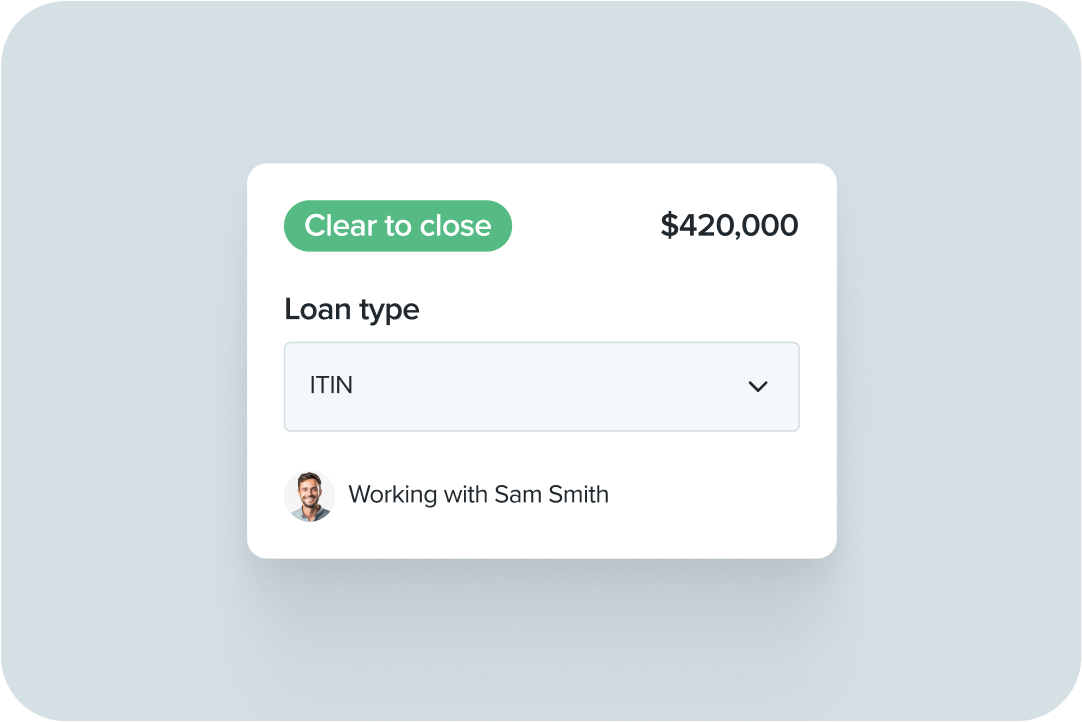

ITIN home loan benefits & guidelines

Your dream of owning a home may seem impossible without a Social Security number or other common documents. However, loans for a borrower with an Individual Taxpayer Identification Number (ITIN) to use as a form of identification can make homeownership a reality. ITIN loans are designed for nonresidents and resident aliens who aren’t eligible for Social Security numbers. These non-qualified mortgage loans, or non-QM loans, have stricter rules but are worth it if you don’t qualify for other loan programs.

Why choose an ITIN home loan?

ITIN home loans often come with lower interest rates, making them a solid solution for borrowers not eligible for Social Security numbers, including those who are in the U.S. without legal documentation or a valid visa.

ITIN home loan guidelines

To qualify for an ITIN mortgage, you will need:

- An Individual Taxpayer Identification Number (ITIN)

- Another form of identification, such as a driver’s license

- Proof of employment history

ITIN loans may have more lenient credit score requirements, but you should speak with a Loan Officer for details. You’ll need to prove at least two years of consistent employment history, which can include self-employment, as well as two years of tax returns.

How to apply for an ITIN home loan

Apply with a lender that specializes in these loans, like Rate. Our Digital Mortgage simplifies the process. Follow these steps.

1. Review your finances

Check your credit score, income, DTI ratio and cash on hand for a down payment.

1. Review your finances

Check your credit score, income, DTI ratio and cash on hand for a down payment.

2. Gather key documents

In most cases, you’ll need to provide income verification, tax returns, asset statements and personal identification.

3. Apply online

Once you submit your application, your Loan Officer will help you from there.

“The Guaranteed Rate Team was very easy to work with! Information was clear and all available through my portal for review at all times. Additionally the team was very responsive to any and all questions we had along the way.”

Applicant subject to credit and underwriting approval. Not all applicants will be approved for financing. Receipt of application does not represent an approval for financing or interest rate guarantee. Refinancing your mortgage may increase costs over the term of your loan. Restrictions may apply.