VA Energy Efficient Mortgage benefits & guidelines

The VA Energy Efficient Mortgage (EEM) program is designed to help eligible active-duty service members, Veterans and surviving spouses finance energy-efficient upgrades to their homes. Backed by the U.S. Department of Veterans Affairs, the EEM program offers the same low rates as standard VA loans.

Why choose a VA Energy Efficient Mortgage?

Whether it’s adding thermal windows, installing a solar water heater or increasing insulation, energy-efficient upgrades can lower your utility bills and make your home more comfortable year-round. Plus, you can roll the cost of improvements into your mortgage, which keeps your loan simple with one monthly payment.

VA Energy Efficient Mortgage guidelines

To qualify for a VA Energy Efficient Mortgage, you will need:

- Home Energy Rating System (HERS) report or energy audit from a utility company, municipality or state agency

- Contractor bid or cost worksheet to document planned upgrades

- Income and credit verification

Getting a VA EEM loan is similar to applying for any VA loan, with a few added steps. You’ll need a home energy audit to identify potential upgrades and estimate savings if improvements are more than $3,000. Projects from $3,000 to $6,000 require your lender to confirm that the monthly utility savings outweigh the increased mortgage payment.

How to apply for a VA Energy Efficient Mortgage

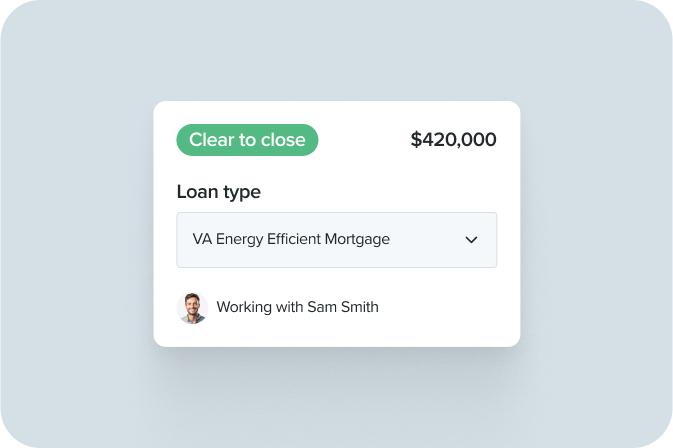

Getting started with a VA EEM is simple with Rate’s Digital Mortgage application. Follow these steps.

1. Check your eligibility

As with any VA loan, you’ll need a military Certificate of Eligibility (COE). Rate can help retrieve yours for you.

1. Check your eligibility

As with any VA loan, you’ll need a military Certificate of Eligibility (COE). Rate can help retrieve yours for you.

2. Gather key documents

Gather documents such as income statements and tax returns to streamline your application.

3. Apply online

Start your application online, and our VA loan specialists will guide you from eligibility to closing.

4. Home energy audit

Arrange for a Home Energy Rating System (HERS) report or energy audit from a utility company, municipality or state agency to identify potential upgrades and estimate their cost and monthly savings.

5. Document your upgrades

Provide detailed cost estimates for your planned improvements, either through contractor bids or a personal worksheet.

6. Lender review

This is to ensure the upgrades align with VA guidelines, with evidence that the energy savings will justify the additional loan amount.

“As first time homebuyers, we had an enormous amount of questions and just overall uncertainty about the entire process. Even though we purchased during the busy holiday season, there was never a time we felt disregarded. From initial approval of our VA loan, to underwriting and closing, the entire process was peaceful.”

Applicant subject to credit and underwriting approval. Not all applicants will be approved for financing. Receipt of application does not represent an approval for financing or interest rate guarantee. Restrictions may apply.

Rate, Inc. is a private corporation organized under the laws of the State of Delaware. It has no affiliation with the US Department of Housing and Urban Development, the US Department of Veterans Affairs, the Nevada Department of Veterans Services, the US Department of Agriculture, or any other government agency. No compensation can be received for advising or assisting another person with a matter relating to veterans’ benefits except as authorized under Title 38 of the United States Code.