VA renovation loan benefits & guidelines

A VA renovation loan could help you buy a fixer-upper and turn it into your dream home by combining the purchase price and home improvement costs into one loan. Backed by the U.S. Department of Veterans Affairs (VA), VA renovation loans are available with 0% down payment and low interest rates. You can even finance your VA funding fee and closing costs, saving more money upfront.

Why choose a VA renovation loan?

A VA renovation loan lets you borrow up to 100% of the home's value after renovations, with low interest rates and no mortgage insurance. You can also consolidate renovation and purchase costs into a single monthly payment, so you can increase the value of your home without juggling multiple loans.

VA renovation loan guidelines

To qualify for a VA renovation loan, you will need:

- No down payment

- Home appraisal

- Military Certificate of Eligibility (COE)

Getting a VA renovation loan starts with a military Certificate of Eligibility (COE) to confirm your VA loan benefits, and Rate can make this step quick and hassle-free. You’ll also need to partner with a VA-registered contractor to create a plan for your renovations and get price quotes. And you’ll need a VA-certified appraisal to determine your home’s as-completed value as well.

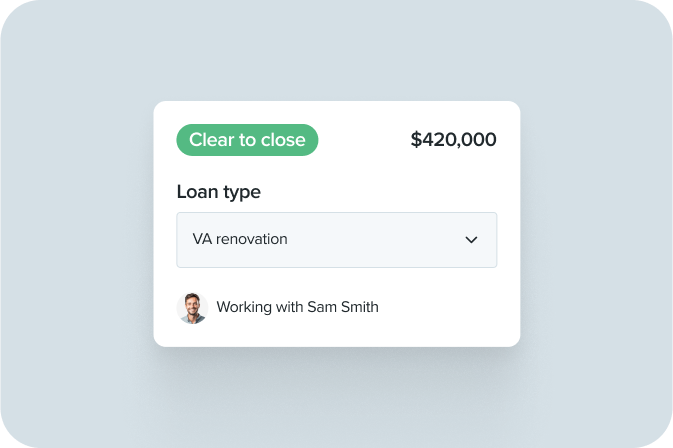

How to apply for an VA renovation loan

Rate’s VA renovation loan application is easy with Rate’s Digital Mortgage. Follow these steps.

1. Check your eligibility

You’ll need a military Certificate of Eligibility (COE). Rate can retrieve yours for you.

1. Check your eligibility

You’ll need a military Certificate of Eligibility (COE). Rate can retrieve yours for you.

2. Gather key documents

Gather documents such as income statements and tax returns to streamline your application.

3. Apply online

Start your application online, and our VA loan specialists will guide you from eligibility to closing.

“As first time homebuyers, we had an enormous amount of questions and just overall uncertainty about the entire process. Even though we purchased during the busy holiday season, there was never a time we felt disregarded. From initial approval of our VA loan, to underwriting and closing, the entire process was peaceful.”

Applicant subject to credit and underwriting approval. Not all applicants will be approved for financing. Receipt of application does not represent an approval for financing or interest rate guarantee. Restrictions may apply.

Rate, Inc. does not guarantee the quality, accuracy, completeness or timelines of the information in this publication. While efforts are made to verify the information provided, the information should not be assumed to be error free. Some information in the publication may have been provided by third parties and has not necessarily been verified by Rate, Inc. Rate, Inc. its affiliates and subsidiaries do not assume any liability for the information contained herein, be it direct, indirect, consequential, special, or exemplary, or other damages whatsoever and howsoever caused, arising out of or in connection with the use of this publication or in reliance on the information, including any personal or pecuniary loss, whether the action is in contract, tort (including negligence) or other tortious action.

Rate does not provide tax advice. Please contact your tax adviser for any tax related questions.