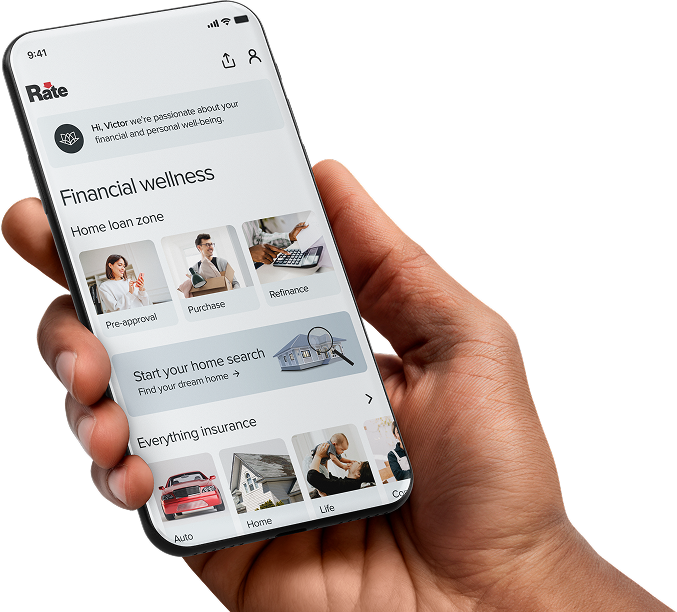

Homebuying meets wellbeing.

Your mortgage doesn’t have to be stressful. We help you stay centered on your path to homeownership.

Shop and compare homes

.png.jpg)

Get pre-approved fast

Close loans from anywhere

.png.jpg)

Access free financial coaching

.png.jpg)

Stream wellness on demand

.png.jpg)

Reduce stress. Live better.

.png.jpg)

Free membership benefits

Check out exclusive savings on essentials home appliances, electronics and more.

Loan experts, right in the app

.svg)

No chatbots

.svg)

Real time updates

.svg)

Connected 24/7

Dedicated support

Instantly connect with the right expert.

Get real-time help when you need it.

Feel confident with a partner on your side.

AI-powered tools

Apply in just 5 minutes.

Get pre-approved within 24 hours.

Approved close in as few as 10 days1

Customers love us

Homebuyers and pros trust Rate for loan tools, expert guidance and fast approvals.

Customers love us

Homebuyers and pros trust Rate for loan tools, expert guidance and fast approvals.

“Helped me find a great home for a great price that fit in my budget! Great with communication, and everyone was very easy to work with and made the process easy and flow effortlessly!”

Brandon P - Facebook review

“Rate helped us to get the loan for our first new home. They were very co-operative and helpful throughout this process."

.svg)

Mthun G Google review

1 Qualified customers who provide required financial documentation within 24 hours of locking a rate have the opportunity to receive a loan approval within one business day of document submission. Borrowers will not receive funding the same day as application submission. Rate cannot guarantee loan approval or a specific closing timeframe. A possible ten day close is not eligible for all loan or property types and requires the property to receive an Appraisal Waiver. Borrower must opt in to AccountChek. Subject to approval. Additional restrictions and requirements apply. https://www.rate.com/same-day-mortgage.

Applicant subject to credit and underwriting approval. Not all applicants will be approved for financing. Receipt of application does not represent an approval for financing or interest rate guarantee. Refinancing your mortgage may increase costs over the term of your loan. Restrictions may apply.

Apple and the Apple logo are trademarks of Apple Inc., registered in the U.S. and other countries. App Store is a service mark of Apple Inc. Google Play and the Google Play logo are trademarks of Google Inc.

.png)

.png)

.png)

.png)

.png)