VA home loan benefits &

guidelines

Home loans backed by the Department of Veterans Affairs (VA) help service members, Veterans and their spouses buy, refinance and renovate homes. Loans are often available with a no down payment option, lower closing costs, good rates and no minimum credit score. If you’re eligible for a VA loan, speaking with an experienced VA lender like Rate can help you take advantage of the savings* this program provides.

Why choose a VA mortgage?

VA mortgages require no down payment and have no income limits. They also do not require private mortgage insurance (PMI) and offer competitive interest rates.

VA home loan guidelines

These are some of the advantages of a Rate VA mortgage.

- No lender fee at closing: Rate has waived an average of $1,640 per VA loan by eliminating the origination fee.

- No minimum credit score: Rate reviews full credit history to help more service members qualify.

- 100% financing available: With Rate's exclusive Zero Down for Heroes program, qualified Veterans can purchase homes with a no down payment option.

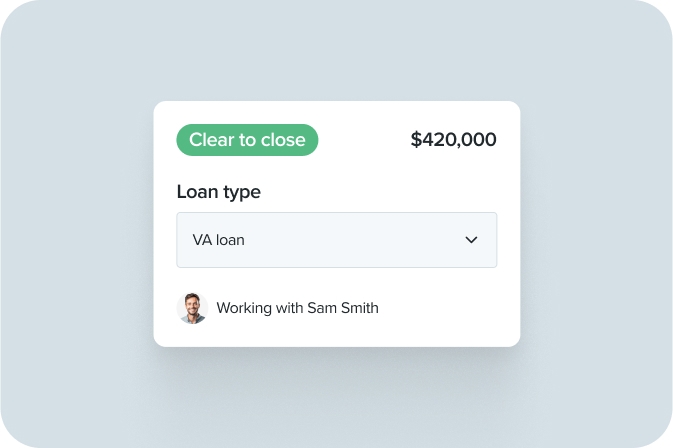

- Fast closings: Rate’s technology means VA loans could close in days. When time matters, we get it done.

- World-class mortgage experts: Connect with a dedicated mortgage pro right from the Rate app to walk you through the process.

You’ll need to verify your eligibility for a VA loan with a military Certificate of Eligibility (COE), which Rate’s specialist can help obtain. Credit requirements are flexible, but you’ll need to prove employment with income statements and tax returns.

VA 30-year fixed

0.000%

What are the current VA loan rates?

Like other mortgage programs, VA loan rates are influenced by housing market trends and the overall state of the economy. Your final rate will depend on your credit score and history of managing debt.

Use the button to see current rates for a VA home loan. See mortgage rate disclaimers for assumptions and details.

How to apply for a VA home loan

Applying for VA home loans and refinancing for service members, Veterans and their families is simple with Rate’s Digital Mortgage.

Follow these steps.

1. Obtain your certificate of eligibility (COE)

You’ll need a military Certificate of Eligibility (COE). Our mortgage specialists can retrieve it for you through the VA's online portal.

1. Obtain your certificate of eligibility (COE)

You’ll need a military Certificate of Eligibility (COE). Our mortgage specialists can retrieve it for you through the VA's online portal.

2. Gather key documents

You’ll need to provide income verification, tax returns, asset statements and personal identification.

3. Take advantage of Zero Down for Heroes

Learn more about Rate’s Zero Down for Heroes program that could allow you to buy a home with a no down payment option.

4. Apply online

Apply online, and our experienced Loan Officers will guide you from eligibility to closing.

.jpg)

“As first time homebuyers, we had an enormous amount of questions and just overall uncertainty about the entire process. Even though we purchased during the busy holiday season, there was never a time we felt disregarded. From initial approval of our VA loan, to underwriting and closing, the entire process was peaceful.”

Applicant subject to credit and underwriting approval. Not all applicants will be approved for financing. Receipt of application does not represent an approval for financing or interest rate guarantee. Restrictions may apply.

Waived $1,640.00 lender fee available for VA loans that have a triggered RESPA app date as of January 1, 2025 through December 31, 2025 at 11:59pm EST. This offer does not extend to Housing Finance Agency loans. ‘Triggered RESPA’ in accordance with Regulation X, is defined as lender receipt of all six pieces of information received in a secure format; applicant name, property address, home value, loan amount, income and SSN. Not all borrowers will be approved. Borrower’s interest rate will depend upon the specific characteristics of borrower’s loan transaction, credit profile and other criteria. Offer not available from any d/b/a or operations that do not operate under the Rate name. Restrictions apply.

Rate, Inc. is a private corporation organized under the laws of the State of Delaware. It has no affiliation with the US Department of Housing and Urban Development, the US Department of Veterans Affairs, the US Department of Agriculture or any other government agency.

Rate cannot guarantee that an applicant will be approved or that a closing can occur within a specific timeframe. All dates are estimates and will vary based on all involved parties level of participation at any stage of the loan process. Contact Rate for more information.

*Savings, if any, vary based on consumer’s credit profile, interest rate availability, and other factors. Contact Rate, Inc. for current rates. Restrictions apply.

**Using funds from a cash-out refinance to consolidate debt may result in the debt taking longer to pay off as it will be combined with the borrower's mortgage principal amount and will be paid off over the full loan term. Contact Rate for more information.

.png)