Home prices up in over 90% of the country in the first quarter

In the first three months of 2024, existing-home sales prices climbed in a staggering 205 out of 221 metro areas, 93% of the country. In addition, the number of metro areas that saw double digit growth was 30%, up 15% from the last quarter of 2023. Overall, the national median single-family existing-home price grew 5% from one year ago to $389,400, according to a report from the National Association of Realtors® (NAR).

This rise in prices is notable because it was accompanied with a rise in mortgage rates, as well. While usually that would depress home prices due to lessening demand, that was not the case to start the year. Fortunately, there are many ways to make homeownership more affordable, particularly for first-time homebuyers.

"Astonishingly, greater than 90% of the country's metro areas experienced home price growth despite facing the highest mortgage rates in two decades," said NAR Chief Economist Lawrence Yun. "In the current market, rising prices are the direct result of insufficient housing supply not meeting the full demand."

Prices rise across the country

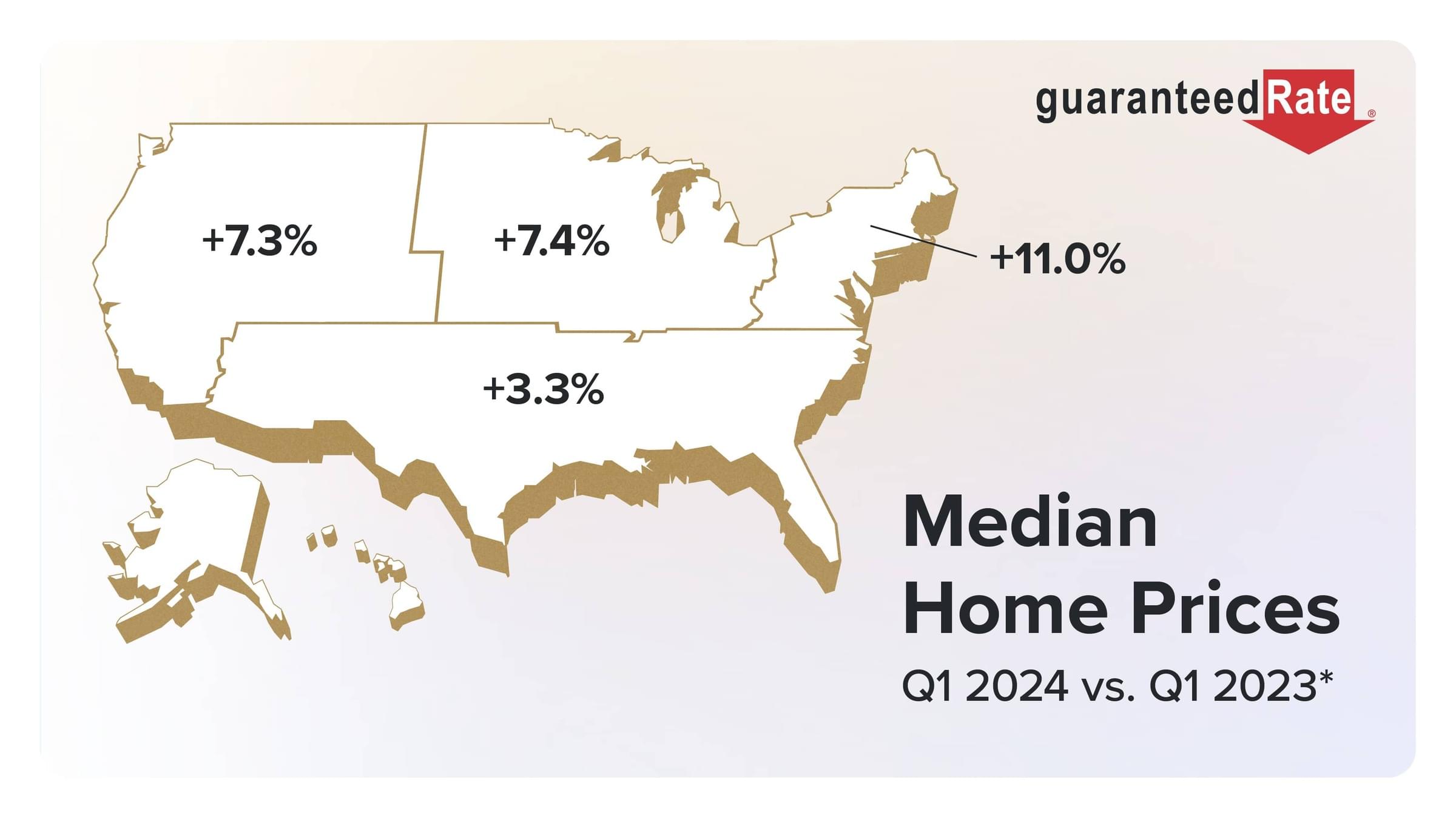

Continuing a trend from the last few quarters, the South saw the largest share of home sales, with 46% of all the nation’s home sales happening in that region. Interestingly, home prices went up by the smallest percentage in the South for the second quarter in a row. Here’s the regional breakdown:

- Northeast: up 11%

- Midwest: up 7.4%

- South up 3.3%

- West: up 7.3%

"The expensive markets in the West, where home prices declined last year, are roaring back," Yun said. "Price dips in that region were viewed as second-chance opportunities by many buyers."

Affordability trends

Even as home prices and mortgage rates increased, housing affordability improved as buyers took advantage of the sporadic dips in rates. The monthly mortgage payment on a typical home with a 20% down payment was $2,037, down 5.7% from the fourth quarter of 2023 ($2,161) but up 9.3% ($1,864) from a year ago. Families spent 24.2% of their income on mortgage payments, down from 26.1% in the prior quarter but up from 23.3% one year ago.

Good news for people trying to buy their first house, as they also saw affordability turn in their favor in the first quarter of 2024. For a typical starter home ($331,000) with 10% down, the monthly mortgage payment is $1,998, 5.7% lower than the previous quarter. It's still higher compared to a year ago, 9.2% more. First-time buyers are spending 36.5% of their money on the mortgage, which is down 2.8% from last quarter.

Top markets for growth

The markets with largest year-over-year increases saw a clustering in the upper Midwest, with Wisconsin and Illinois showing the greatest price appreciation. These regional variations show how important it is for buyers to work with local experts:

- Fond du Lac, Wis. (23.7%)

- Kankakee, Ill. (22.0%)

- Rockford, Ill. (20.1%)

- Champaign-Urbana, Ill. (20.0%)

- Johnson City, Tenn. (19.3%)

- Racine, Wis. (19.0%)

- Newark, N.J.-Pa. (18.8%)

- Bloomington, Ill. (18.5%)

- New York-Jersey City-White Plains, N.Y.-N.J. (18.4%)

- Cumberland, Md.-W.Va. (18.2%)

The most expensive markets in the U.S. remain very similar from the past few quarters. Once again, they are mostly all out West, continuing a long-standing trend:

- San Jose-Sunnyvale-Santa Clara, Calif. ($1,840,000; 13.7%)

- Anaheim-Santa Ana-Irvine, Calif. ($1,365,000; 14.2%)

- San Francisco-Oakland-Hayward, Calif. ($1,300,000; 14%)

- Urban Honolulu, Hawaii ($1,085,800; 5.5%)

- San Diego-Carlsbad, Calif. ($981,000; 11.5%)

- San Luis Obispo-Paso Robles, Calif. ($909,300; 7%)

- Oxnard-Thousand Oaks-Ventura, Calif. ($908,700; 7.6%)

- Salinas, Calif. ($899,200; 4.1%)

- Naples-Immokalee-Marco Island, Fla. ($850,000; 9.4%)

- Los Angeles-Long Beach-Glendale, Calif. ($823,000; 10.2%)

Source: https://www.nar.realtor/newsroom/more-than-90-percent-of-metro-areas-home-price-increase-1Q-2024

.jpeg)