USDA home loan benefits & guidelines

Backed by the U.S. Department of Agriculture (USDA), a USDA mortgage is designed to help borrowers purchase and refinance homes in eligible rural and suburban areas. Loans are available with no down payment, competitive interest rates and lower mortgage insurance costs compared to other loan types. USDA’s Single-Family Home Loan Guarantee offers affordable financing with no down payment required.

Why choose a USDA mortgage?

Since USDA loans are up to 90% government-backed, they are available with lower rates for borrowers who have low to moderate incomes and meet program criteria in designated rural areas. Over 95% of U.S. land is considered “rural” and eligible for USDA loans.

To qualify for a USDA mortgage, you will need:

- Minimum credit score of 620

- Property in a region classified as rural

- Income not higher than 115% of median in your area

USDA mortgages are exclusively fixed-rate, 30-year loans. Eligibility requirements include credit and income verification, but the income cap could be adjusted depending on how many adults live in the home. Also, your total debt-to-income (DTI) ratio should generally be no more than 41%.

As long as a property is eligible and the borrower meets all USDA requirements, there are USDA mortgage options for home purchases and refinancing. If you have a USDA home loan, refinancing could lower your monthly payment.

- USDA standard streamline refinance

- This refinancing option allows borrowers with a USDA home loan to lower their interest rate and monthly payments.

- USDA streamlined-assist refinance

- Similar to the standard streamline refinance, this option often does not require a credit check or income verification.

- Non-streamlined refinance

- This refinancing option requires a new appraisal of the property in addition to other guidelines.

USDA 30-year fixed

0.000%

What are the current USDA home loan rates?

Like many other mortgage options, USDA interest rates are influenced by housing market trends and the broader economy. Your final rate will depend on your credit score and history of managing debt. Use the button to see current rates for USDA home loans. See mortgage rate disclaimers for assumptions and details.

How to apply for USDA home loan

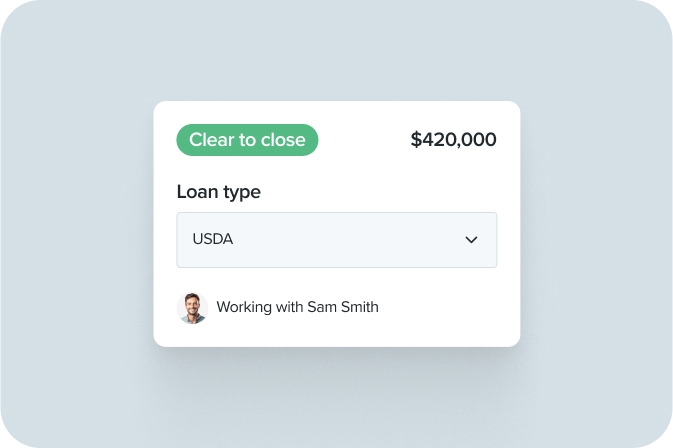

Applying for a USDA home loan is easy with Rate’s Digital Mortgage. Follow these steps.

1. Determine if you're eligible

Key USDA home loan eligibility requirements include location, residency and occupancy, income, debt-to-income(DTI) ratio and credit score. The USDA's map can help determine your eligibility.

2. Gather key documents

You’ll need to provide income verification, tax returns, asset statements and personal identification.

3. Apply online

Apply online, and our Loan Officers can help you navigate the USDA mortgage process.

“The Guaranteed Rate Team was very easy to work with! Information was clear and all available through my portal for review at all times. Additionally the team was very responsive to any and all questions we had along the way.”

Applicant subject to credit and underwriting approval. Not all applicants will be approved for financing. Receipt of application does not represent an approval for financing or interest rate guarantee. Restrictions may apply.

Savings, if any, vary based on the consumer’s credit profile, interest rate availability, and other factors. Contact Rate for current rates. Restrictions apply.

Rate, Inc. is a private corporation organized under the laws of the State of Delaware. It has no affiliation with the US Department of Housing and Urban Development, the US Department of Veterans Affairs, the US Department of Agriculture, or any other government agency.