VA IRRRL benefits & guidelines

Backed by Department of Veterans Affairs (VA), the VA Interest Rate Reduction Refinance Loan (IRRRL) with a complicated name offers a simple way to lower your interest rate and monthly payment. Also known as a VA streamline refinance, a VA IRRRL for borrowers who have a VA home loan has fewer steps and better terms. It is available to eligible active-duty service members, Veterans and surviving spouse.

Why choose a VA IRRRL?

The VA IRRRL offers flexible lending requirements, so borrowers don’t need to meet specific credit scores to qualify. Plus, a home appraisal, credit check or income review are not required for most types of IRRRLs.

VA IRRRL guidelines

To qualify for a VA IRRRL, you will need:

- Current VA mortgage

- Military Certificate of Eligibility (COE)

- Property that is your primary residence

As with any refinance, there are closing costs associated with a VA IRRRL, including a VA funding fee. The good news is that the VA funding fee for IRRRLs is 0.5%. Borrowers can roll closing costs into their loan and pay them off over time. Also, Rate has no lender fees on any VA loan.

How to apply for a VA IRRRL Mortgage

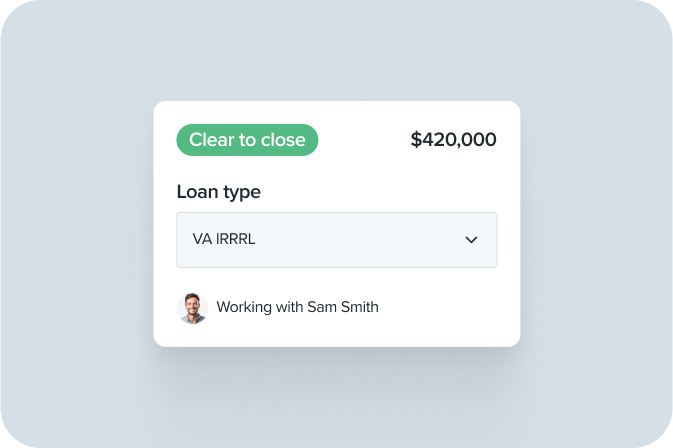

Applying for a VA IRRRL is simple with Rate’s Digital Mortgage. Follow these steps.

1. Check your eligibility

You’ll need a military Certificate of Eligibility (COE). Rate can retrieve yours for you.

1. Check your eligibility

You’ll need a military Certificate of Eligibility (COE). Rate can retrieve yours for you.

2. Gather key documents

Gather documents such as income statements and tax returns to streamline your application.

3. Apply online

Start your application online, and our VA loan specialists will guide you from eligibility to closing.

“As first time homebuyers, we had an enormous amount of questions and just overall uncertainty about the entire process. Even though we purchased during the busy holiday season, there was never a time we felt disregarded. From initial approval of our VA loan, to underwriting and closing, the entire process was peaceful.”

Applicant subject to credit and underwriting approval. Not all applicants will be approved for financing. Receipt of application does not represent an approval for financing or interest rate guarantee. Restrictions may apply.

Rate, Inc. is a private corporation organized under the laws of the State of Delaware. It has no affiliation with the US Department of Housing and Urban Development, the US Department of Veterans Affairs, the Nevada Department of Veterans Services, the US Department of Agriculture, or any other government agency. No compensation can be received for advising or assisting another person with a matter relating to veterans’ benefits except as authorized under Title 38 of the United States Code.

*Waived $1,640.00 lender fee available for VA loans that have a triggered RESPA app date as of January 1, 2025 through December 31, 2025 at 11:59pm EST. This offer does not extend to Housing Finance Agency loans. ‘Triggered RESPA’ in accordance with Regulation X, is defined as lender receipt of all six pieces of information received in a secure format; applicant name, property address, home value, loan amount, income and SSN. Not all borrowers will be approved. Borrower’s interest rate will depend upon the specific characteristics of borrower’s loan transaction, credit profile and other criteria. Offer not available from any d/b/a or operations that do not operate under the Rate name. Restrictions apply.